The CENSI-BOUVARD device (or Bouvard law) is a rental investment system which was created in 2012, to obtain a tax reduction (tax exemption system).

S'informer

Censi-Bouvard: can you benefit from this?

It is aimed at taxpayers residing in France who shall buy, until December 31, 2022:

- A new dwelling.

- VEFA housing (housing for sale in the future completion state).

- completed home, at least 15 years ago and which has been or is subject to rehabilitation or renovation works which, after the completion, are in keeping with the technical performance criteria

Housing allocation

The housing must be located in:

- a social or medico-social establishment which accommodates elderly or disabled adults (article L. 312-1, I, 6 ° and 7 ° of the social action and family code);

- an establishment providing long-term care (mentioned in the tenth paragraph of 3 ° of Article L. 6143-5 of the Public Health Code), including an accommodation, for people who aren’t self-sufficient in life and whose condition requires constant medical supervision and care.

- a residence with services for the elderly or disabled who have obtained the "quality" approval referred to in article L. 7232-1 of the Labor Code or the authorization provided for in Article L. 313-1 of the Labor Code social action and families for help and support at home under 6 ° or 7 ° of article L. 312-1 of the same code;

- a set of accommodation managed by a social or medico-social cooperation group and assigned to the fostering family of the elderly or disabled (articles L. 444-1 to L. 444-9 of the social action and family code).

- a residence with services for students (student residences).

Censi-Bouvard: Conditions concerning the beneficiary

Non-professional activity

Only taxpayers with the status of Hirer out with Furnished non-professional status, can benefit from this tax reduction. Those who exercise the activity of renting furnished accommodations under a professional status at the time of the accommodation’s acquisition, are therefore excluded.

Direct acquisition of a building

The investment must be made by the individual taxpayer, and not through a company.

Industrial and commercial benefits

Rental income must be taxed in the industrial and commercial profit category for the duration of the rental commitment.

Censi-Bouvard: conditions related to rental

Furnished rental

The accommodation must be rented furnished.

Sub-division of property rights

The reduction is not applicable in respect of dwellings for which the ownership right is sub-divided.

Effective date of lease

The rental must take effect in the month following the completion or acquisition, whichever is later.

Duration of rental

The owner agrees to rent the accommodation for at least nine years to the holder of the establishment or residence. The nine-year term shall be computed from the effective date of the initial lease.

Careful: In the event of a change of holder during the commitment period, the accommodation must, without exceptions, be rented to the new operator within one month.

Advantages of the Censi-Bouvard system

The tax reduction is equal to 11% excluding tax of the purchase or cost price over 9 years, limited to 300,000 euros of investment per year. For accommodations which go through rehabilitation works, the base is calculated with the purchase price plus the value of the works.

This amount is subject to an overall price-cap on tax loopholes of 10,000 euros.

It should be noted: if the tax reduction exceeds the tax due for the tax year, the balance may be deducted from the due income tax for the following years, within the limit of 6 years.

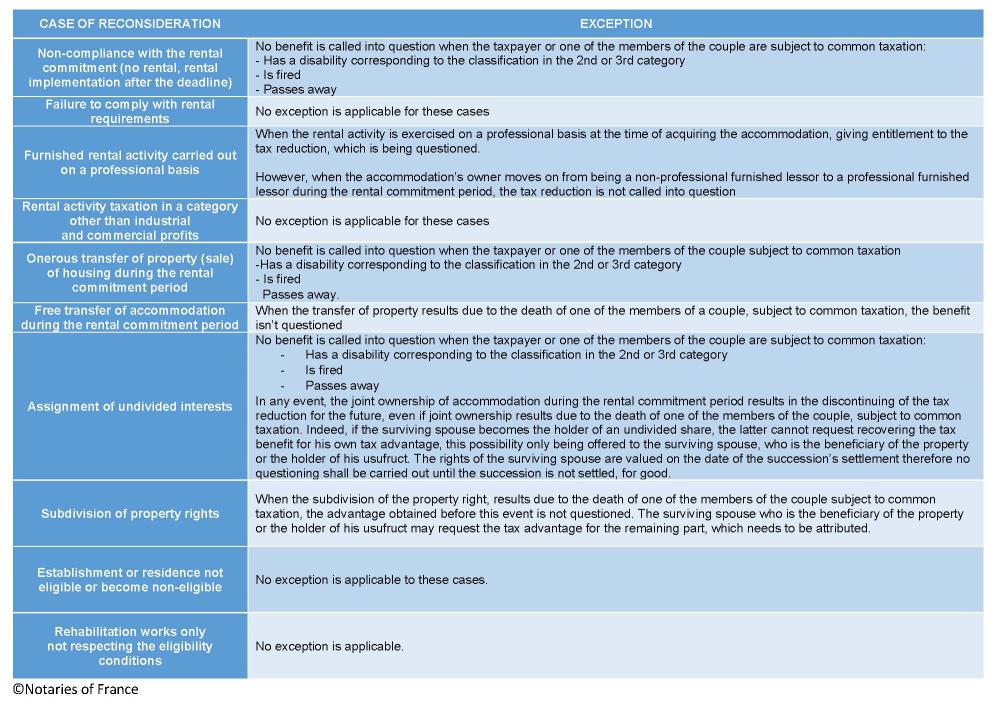

Censi-Bouvard system: in case of a reconsideration

Click on picture to enlarge

Image (1000*yyy)

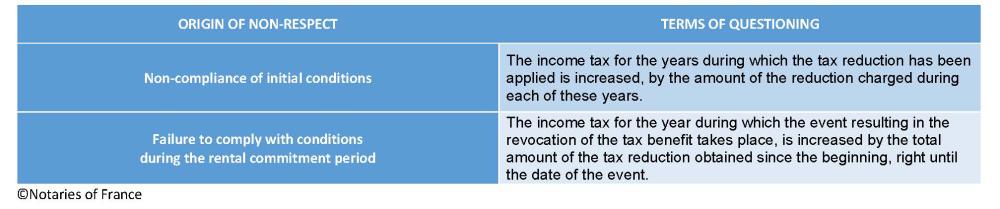

Censi-Bouvard system: procedures of reconsideration

Image (1000*yyy)

It should be noted: it is all subject to applicable penalties.