Inquire

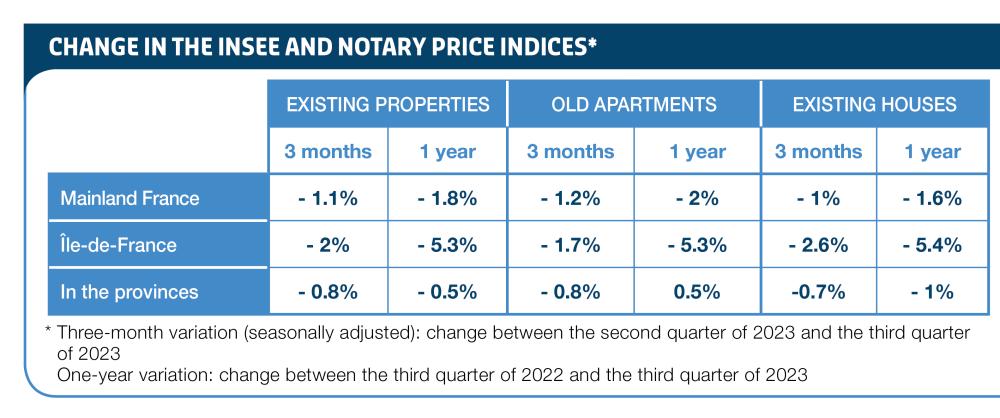

Change in the INSEE and notary price indices

Image (1000*yyy)

Decrease(s)

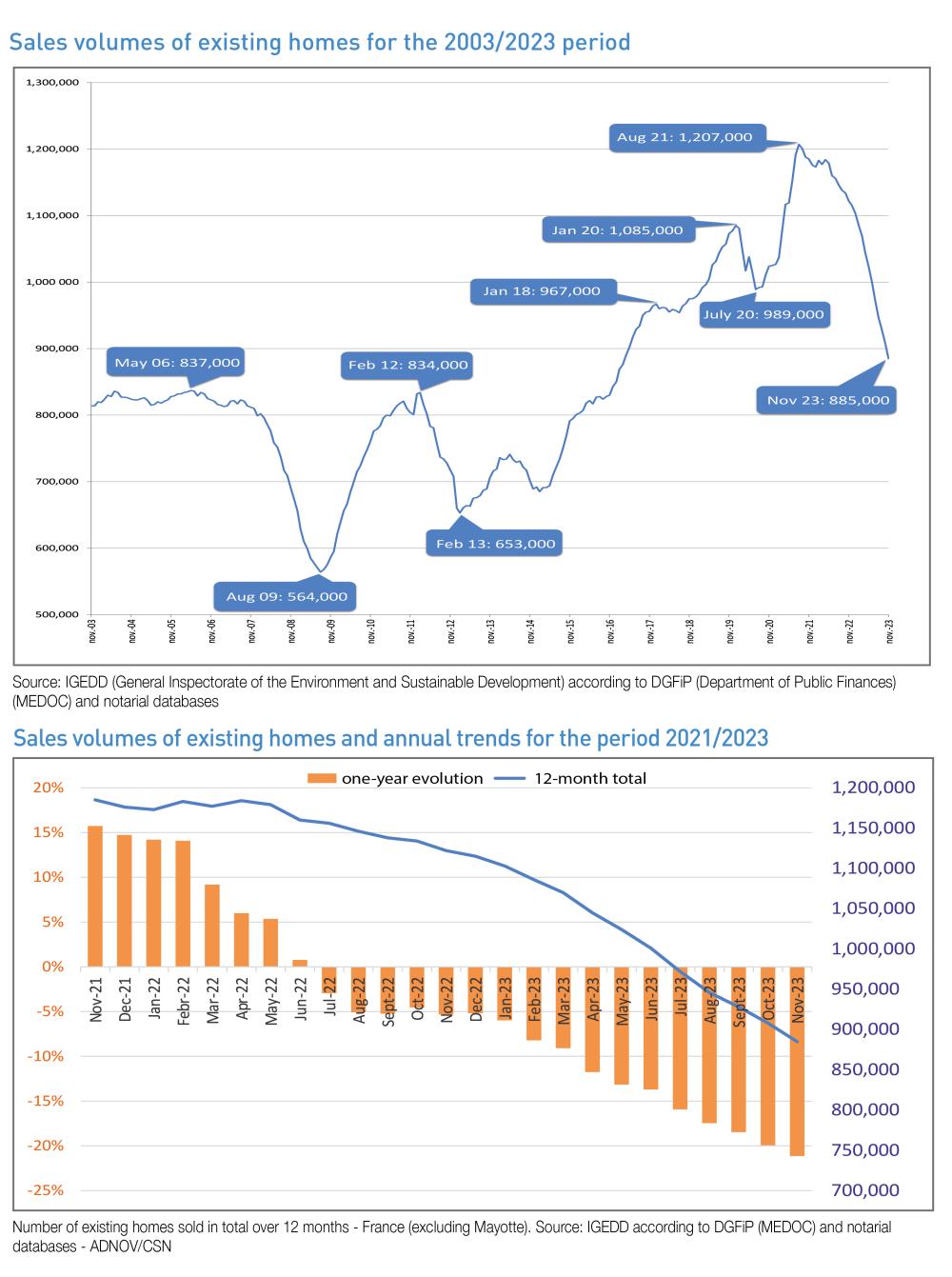

The cumulative volume of transactions in existing homes over the last twelve months in France (excluding Mayotte) amounted to 885,000 transactions at the end of November 2023. The annual decrease is amplified from month to month and now exceeds 20%, at -21.1%. It is necessary to go back to the beginning of 2013 to see such a significant annual decline and to April 2017 to return to volumes below 900,000 transactions. The correction in volumes in 2023 was stronger than expected at the beginning of the year. At the current rate, a year-end of around 860,000 transactions can no longer be ruled out, i.e. 255,000 fewer transactions than in 2022, which ended with 1,115,000 transactions. The fall in volumes is expected to continue, perhaps less quickly in the coming months, with prices that have been slow to decrease and rates at a high level but which could also fall in the coming months.

In view of the ECB’s latest monetary policy decisions, most of the disruption created by the rise in key interest rates in the real estate market now seems to be behind us, even though the coming months, at least until the summer, do not point to an active recovery. Nevertheless, the ECB1 decided to leave its key rates unchanged and inflation, despite a slight technical rebound at the end of the year, has slowed significantly in recent months and is even expected to “gradually decline during 2024, before approaching the Governing Council’s 2% target in 2025”.2

1 - ECB Press release, 25 January 2024

2 - ECB Economic Bulletin No. 8/2023

The period is stabilising, although notaries are seeing a few rate cuts here and there. In this context, however, transaction volumes are likely to continue to decline, perhaps at a slower pace pending significant declines in both rates and prices. The market could thus reach a new maturity.

Prices of existing homes in metropolitan France, fell year-on-year to -1.8% in the 3rd quarter. Prices fell by 1.6% for houses and 2% for apartments. Prices of existing homes continued to fall significantly, losing as much as 4.2% in February 2024. Although prices of existing apartments are falling slightly more than those of existing houses in the 3rd quarter of 2023, this will no longer be the case in early 2024, with equivalent annual price reductions in both markets.

Image (1000*yyy)

In the provinces, prices of existing homes are expected to continue to fall less rapidly than in metropolitan France, with around -3% year-on-year at the end of February 2024. Prices of existing homes are expected to fall at almost the same rate as in mainland France, but the decrease in prices of existing apartments in the provinces will be lower, at around -2%. The prices of existing apartments continued to increase over one year at the same pace in Le Havre (+3%) and Aix-en-Provence (+2%), while prices fell by around 6% in Angers and Saint-Etienne but up to more than 10% in Caen, Grenoble and Nantes. The prices of old houses in the areas of Toulouse, Mulhouse and Marseille - Aix-en-Provence are expected to fall at the same rate at the end of February 2024, from 4 to 7%. Like apartment prices, house prices in the Anjou area are also set to fall, but more sharply, by just over 10% year-on-year. The fall was of the same order in the conurbations of Saint-Etienne, Le Havre, Valenciennes, Nantes, Amiens, Lille and Lyon..

In Île-de-France, according to leading indicators on preliminary contracts, the price of apartments is expected to be 9,630 € per m² in February 2024 in Paris, i.e. a fall of 7% in one year. The annual fall in apartment prices was 8.7% in the inner suburbs and 6.4% in the outer suburbs. In one year, from February 2023 to February 2024, house prices are expected to fall by 6.9% (-7.5% in inner suburbs, -6.7% in outer suburbs).

Price adjustment is becoming widespread and this could encourage cautious and in some cases wait and see sellers to sell. In view of the price increases of recent years, there is nothing prohibitive. In a market where buyers seem to be regaining the upper hand, with a clear appetite for property purchases, 3, price levels remain relatively positive for sellers and it could be worthwhile entering the market now, before prices fall further.

Nevertheless, let’s hope, however, that 2024 will see a more dynamic property market, as long as there are no geopolitical upheavals. There are encouraging signs that the situation will be more buoyant before the summer, with prices and interest rates set to fall at the same time, automatically increasing the amount of money households have left to live on and their ability to commit to property purchases.

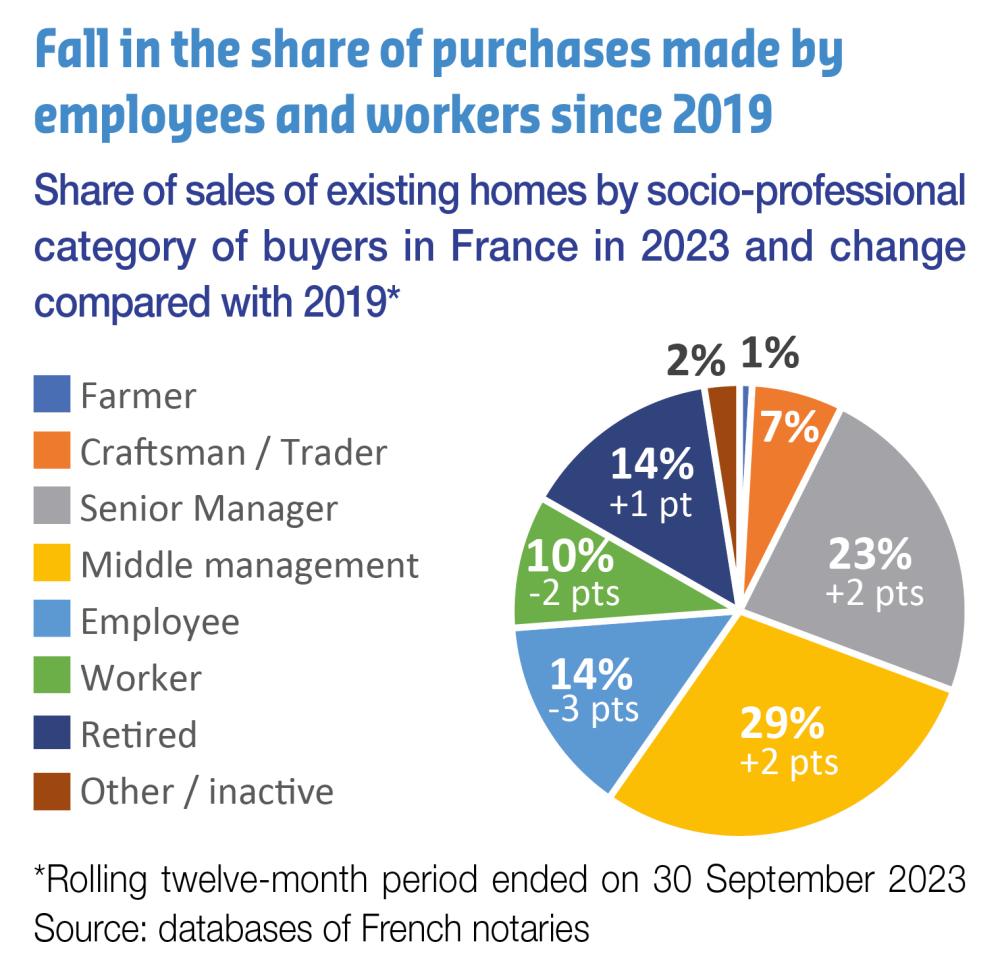

Fall in the share of purchases made by employees and workers since 2019

Share of sales of existing homes by socio-professional category of buyers in France in 2023 and change compared with 2019*

Image (1000*yyy)

At the end of September 2023, 52% of transactions for existing homes in France were conducted by buyers in an “middle management” or “senior manager” position. The other half are mainly “retired” (14%), “employees” (14%) and “blue-collar” (10%) purchasers. From 2019 onwards, the proportion of “white-collar” and “blue-collar” buyers has gradually declined over the period to 2023 (from 29% to 24%), mainly to the benefit of “middle Managements” and “senior managers” (from 48% to 52%). This decline was also, to a lesser extent, in favour of “retirees”, whose share gained one point over the same period.

3 - See Harris survey for the Conseil supérieur du notariat

- Les Français et l’immobilier, parcours et présentations

- wave 3 - 2023 - www.notaires.fr/fr/media/1178

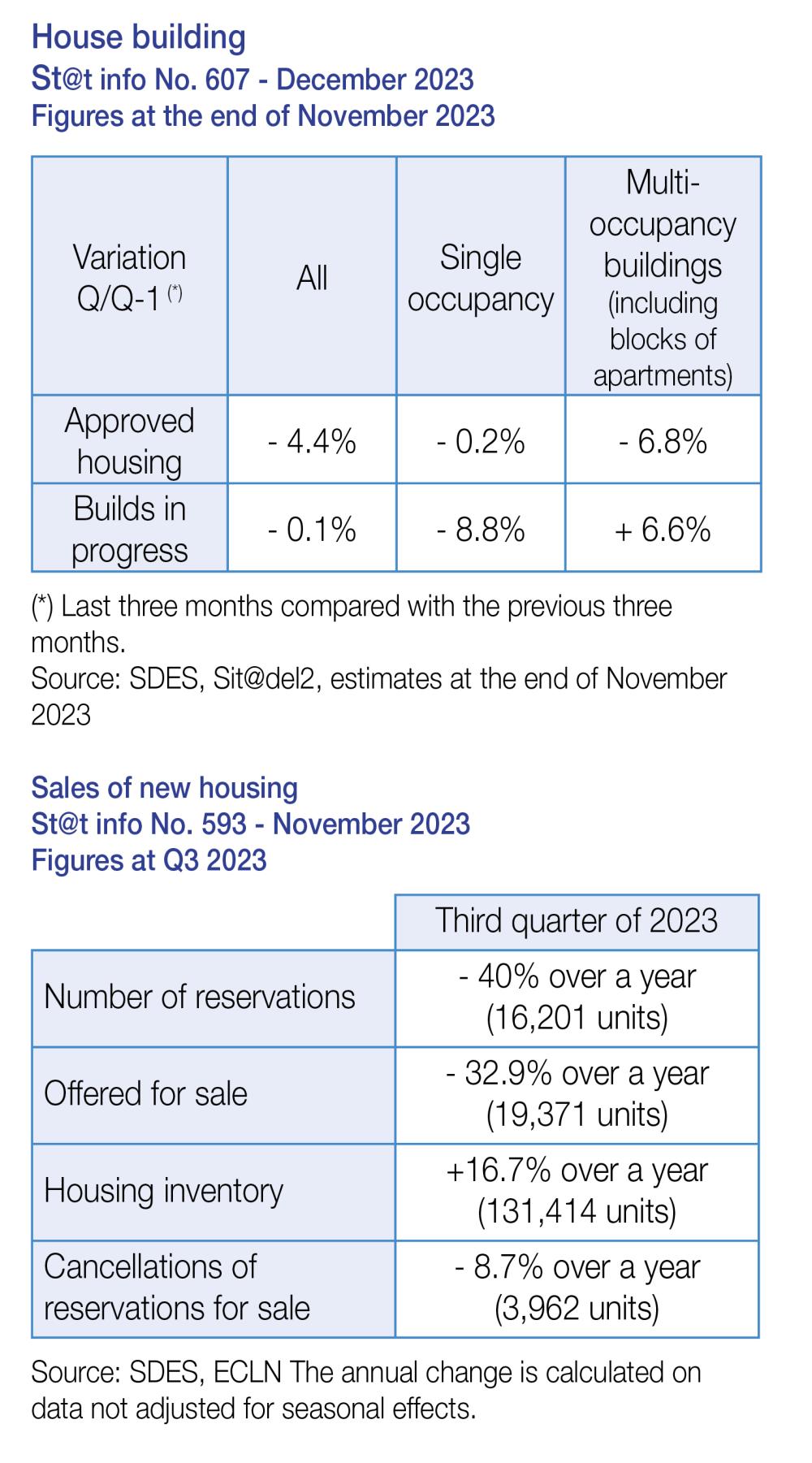

The new housing market - Key figures

The new-build market is suffering from endemic difficulties with a constantly declining housing supply. In 2023, 373,100 homes were authorised for construction, i.e. 115,900 fewer than in the previous year (-23.7%) and 19% less than in the twelve months preceding the health crisis (March 2019 to February 2020). In the third quarter of 2023, year on year, the number of bookings fell very sharply (-40%). This decline concerns both new construction (-39.9%) and existing construction (-40.8%). Year-on-year sales fell sharply (-32.9%). This fall is 33.5% for new constructions and 28.2% for existing constructions. The outstanding amount of new housing offered for sale increased by 16.7% year on year. The level of outstanding housing is 131,400 homes, a historically high level.

Image (1000*yyy)

Credit - Results at end of November 2023 - Banque de France Data

The quasi-systematic use of fixed, non-adjustable property rates continues to provide security for French borrowers in addition to securing the receivables and collateral of national retail banks.

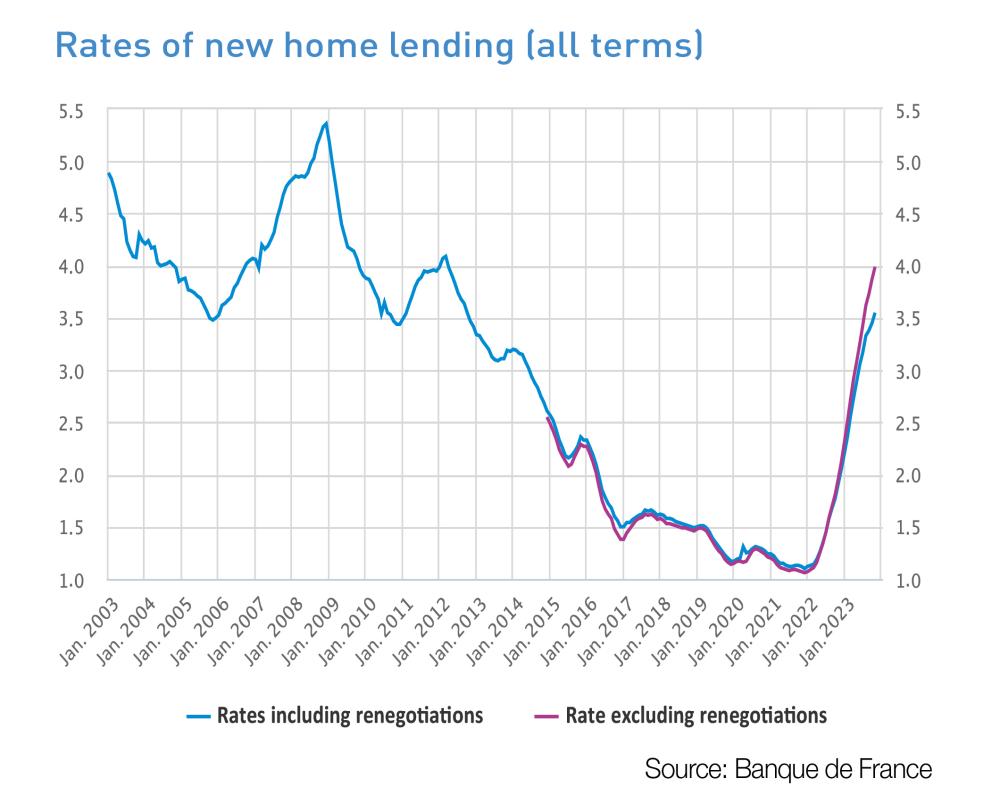

Monthly new home loans excluding renegotiations remain low

New home loans (CVS) excluding renegotiations amounted to €8.7 billion in November (after €9.2 billion in October and September). The annual growth rate of outstanding housing continued to slow (+1.3% in November 2023, after +1.6% in October) while remaining above the Eurozone average. The average interest rate, excluding fees and insurance, on new home loans (excluding renegotiations) continued to rise in November (3.99%, after 3.87% in October) and gradually caught up with the rates observed in some of our European neighbours. The annual growth rate of consumer credit fell slightly in November to +1.9% after +2.2% in October.

1 - www.banque-france.fr/fr/statistiques/credits-aux-particuliers-nov-2023-nov-2023

Image (1000*yyy)

The collective DPE, mandatory for large co-ownerships since 1st January 2024

Image (1000*yyy)

In general, the Energy Performance Survey (DPE) provides information on the energy and climate performance of a dwelling or building (labels A to G), by assessing its energy consumption and its impact in terms of greenhouse gas emissions.

The DPE (Energy Performance Survey) is part of the energy policy defined at European level, in order to reduce the energy consumption of buildings and limit greenhouse gas emissions. It is particularly used to identify energy DPE (DPE F and G labels, i.e. homes that consume the most energy and/or emit the most greenhouse gases).1. Its purpose is to inform the purchaser or lessee of the “green value”2, to recommend work to be carried out to improve it and to estimate its energy costs.

The establishment of a DPE is mandatory at the time of the sale of a dwelling or a building, at the time of the signing of a lease agreement for a dwelling or a residential building, as well as for new buildings. In the event of a sale or lease, the DPE is integrated into the technical survey file (DDT) which contains all the findings or reports that must be appended to the preliminary sale agreement or the lease agreement. The DPE must be made available to any prospective purchaser or tenant who so requests, as soon as the accommodation or building is put up for sale or lease.

1 - www.ecologie.gouv.fr/diagnostic-performance-energetique-dpe

2 - See Notaires de France – The green value of housing in 2022

Since 1st January 2024, Article 158 of the Climate and Resilience Act of 22 August 2021 has made mandatory a so-called collective DPE for all co-ownerships whose building permit was filed before 1st January 2013. This new survey is applicable to co-ownerships of more than 200 lots and the sale of single-owned buildings (of more than two housing units): the legislation does not only refer to co-ownerships and also applies to collective housing buildings; the collective housing building is defined as a building for main residential use strictly grouping together more than two partially or totally superimposed housing units.

The collective DPE provides important information to future tenants and landlords :

- a description of the initial condition of the co-ownership;

- an indication of the building’s consumption;

- an energy label and a climate label, from A to G;

- recommendations for work to improve the energy performance of the building.

Once completed, the DPE is valid for 10 years and must be renewed or updated, except for those completed after 1st July 2021 and which classify the building in class A, B or C.

This survey will be mandatory on 1st January 2025 for co-ownerships with between 50 and 200 residential lots and on 1st January 2026 for those comprising less than 50 lots. For Martinique, Guadeloupe, French Guiana, Réunion and Mayotte, the date of application is 1st January 2028.

Coordination with the individual DPE and energy audit

The individual DPE will only relate to the housing unit, then the collective DPE will indicate the energy performance of the entire building, including the common areas.

The energy audit, while it is not yet mandatory for co-ownerships, goes further than the collective DPE and focuses on the cost of the recommended works.

Read the French property market report in PDF

French property market report N0.62 - January 2024

French property market report N0.62 - January 2024