The wealth tax (IFI) is a tax on the real estate assets for individuals, which has replaced the solidarity wealth tax (ISF) since January 2018. Indeed, the ISF (income tax) has been removed. It is due by taxpayers whose real estate asset exceeds a limit 1,300,000 euros. Real estate assets whose net worth on January 1 is less than this amount, is therefore not subject to the IFI.

Inquire

Which people are taxable for IFI?

- Natural persons who are tax registered in France are theoretically subject to the IFI, on the basis of all their real estate (whether located in France or abroad).

- Individuals who are tax registered abroad, are subject to the IFI on the basis of their property, which is located in France.

- People who return to France after having resided abroad for the past 5 years are, during the 5 years following their return, taxable for the IFI only on their property which is located in France.

How does the taxation take place?

The taxation is calculated per tax household.

A person living alone (celibacy, widow, divorce, separation) constitutes, in itself, as a full tax household.

Married couples form the same tax household and are therefore subject to common taxation on all of their property (own property and common property), regardless of their matrimonial property regime. However, there are 2 exceptions to the rule:

- When the spouses are married under the regime of separation and they live separately, each of the spouses shall be liable to the IFI but solely on their personal heritage.

- When the spouses are in the midst of a legal separation or divorce, are authorized to live separately.

Are also subject to common taxation under the IFI on all of their assets (common or not):

- people in cohabitation

- people in civil union

It should be noted: property belonging to minor children is taxed, and therefore declared with the one of their parents, who have the statutory administration of their property. This can be divided equally between the two parents, when the latter is subject to separate taxation, in terms of the IFI while exercising joint parental authority. On the other hand, the property belonging directly to adult children is not part of the taxable estate of their parents, even if the children have requested their incorporation, to their parents' tax household, for the income statements.

Which assets can be taxed with the wealth tax?

Subject to exemptions, the taxable property in terms of the IFI, is the property, rights and values belonging to the tax household dated January 1, and mostly:

- built buildings (houses, apartments, etc.), and undeveloped buildings (land, agricultural land, etc.). It should be noted that the main residence benefits from a 30% reduction on its value.

- Investments related to real estate: SCPI, OPCI

- The fraction of the redemption value dated January 1, 2018 representative of taxable real estate assets included in accounting units of life insurance contracts.

Which assets are exempted from the wealth tax?

Are mostly exempted:

- professional real estate, which means the required property for pursuit of the occupation, which is the main activity of the taxpayer and of his spouse, civil union partner, cohabiting partner, and minor children: business, land agricultural, medical office, etc.). Professional furnished rentals entitle you to this exemption.

- up to 3/4 of their value, timber and forests as well as shares in forestry communities (on the other hand, shares in forest savings plans, do not give right to an exemption).

What are the deductible liabilities?

These are property debts payable by the taxpayer on January 1 of the taxation year, in particular:

- ongoing property loans (up to the amount of remaining due capital).

- debts related to the payment of improvement, construction, reconstruction or enlargement works.

- taxes which have not been paid yet, on the basis of immovable property such as property tax. The housing tax is not deductible.

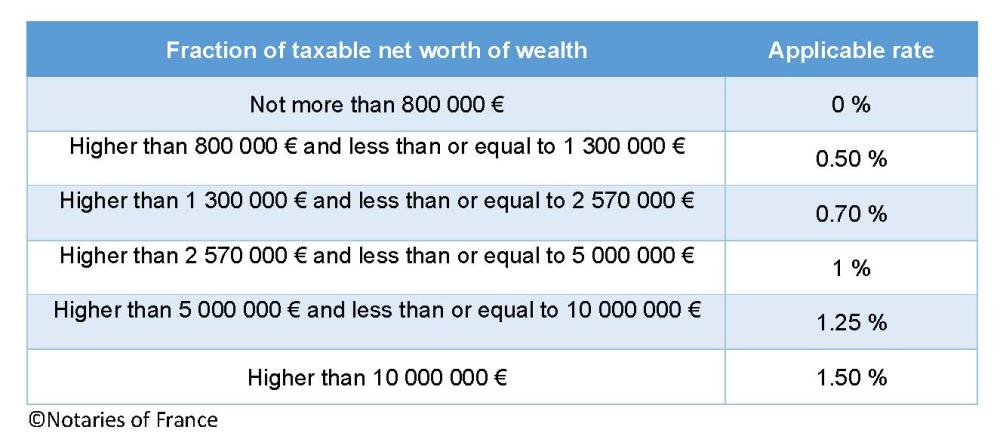

What is the tax rate schedule?

When the net value of taxable assets exceeds 1.3 million euros, the wealth tax (ISI) is calculated using a progressive schedule, which is the same as for the old solidarity wealth tax (ISF). Solidarity tax on wealth (ISF). It is made up of six tax brackets with rates ranging from 0 to 1.5% apply.

The schedule is the following :

Image (1000*yyy)

As soon as the limit of 1.3 million euros has been exceeded, the calculation of the tax begins at 800,000 euros. For example, for real estate assets valued at 1.3 million euros, the IFI is also calculated on the brackets between 800,000 and 1.3 million euros, i.e. 500,000 euros at the rate of 0 , 5%.

A discount mechanism is implemented for assets whose net worth is between 1.3 and 1.4 million euros.

Moreover, taxpayers of the IFI having their tax domicile in France, may benefit from an upper limit. The amount of the IFI is then reduced by the difference between:

- the total of the IFI and taxes due in France and abroad on income and products for the previous year,

- and 75% of total worldwide income net of professional expenses for the previous year but also the income exempt from income tax or subject to withholding tax carried out during the same year in France and outside France.

The IFI must be declared at the same time as the income tax. On the other hand, if you do not have taxable income for income tax, you must complete the 2042-IFI-COV declaration.

For more information, contact your notary. The latter will give you detailed information, not to mention the required clarifications, while taking your personal situation into account.