The analysis of the real estate market is derived from the French property marker report of notaires de France. It presents the real estate situation in France: trend and evolution of real estate prices.

Inquire

Consult the french property market report No58 in this interactive version

French property market report N0.58 - january 2023

French property market report N0.58 - january 2023

Rebalancing or structural decline?

The cumulative volume of transactions in old properties over the last twelve months in France (excluding Mayotte) reached 1,116,000 transactions at the end of November 2022, still higher than the record set at the end of 2019 before the health crisis.

Image (1000*yyy)

However, the slowdown observed since the 4th quarter of 2021 has accelerated in recent months, reaching -6% year-on-year since August 2022, which proves

that the decline is now a trend. Admittedly, the changes recorded from April 2021 to February 2022 were very strong, but the surge in activity - with a peak of +23% year-on-year in August 2021 - is now in fact over: notaries had already detected at that time, in addition to a post-lockdown catch-up effect, a phenomenon of anticipation of future real estate transfers over a usually longer period of time, as the health crisis has acted as a catalyst and accelerator in real

estate decision-making. The recent adjustment in volumes, which we are witnessing, reflects this forecast.

While volumes have started to fall, prices have not. The upward trend observed in previous quarters continues, whether for old apartments or old houses. Nevertheless, it can be noted that in the 3rd quarter of 2022, the magnitude of price changes is more contained. Notaries note the return of price negotiations, a sign of a softening of the rise and a more balanced environment for discussions between buyers and sellers.

Energy performance is increasingly becoming a factor in price negotiations. Moreover, the slowdown in the rise in old property prices should be significant at the end of February 2023, particularly for old houses, which had risen more sharply after the lockdown. The “psychological reaction” after the lockdown seems to be slowly fading. Moreover, while at the end of 2021 the share of Ile-de-France buyers was increasing in the majority of French departments, the situation was different at the end of 2022, when their share had stabilised or shrunk in almost all departments. The largest decreases are mainly observed in the departments bordering or close to Île-de-France, where the share of Île-de-France buyers was the largest and where it had increased most strongly a year ago.

The real estate market, after having reached its peak, is rebalancing, both because of the end of the momentum following the health crisis and because of the continued rise in real estate rates which, due to their extreme weakness, had greatly boosted the market. It should be noted that inflation could continue

to alter demand and therefore cause volumes to fall even more sharply, especially as it is likely to weigh on the “disposable income” of potential buyers,

especially if the gap between wage increases and price increases is significant. Moreover, while the usury rate may have caused some tension in recent

months, the decision by the Banque de France, in agreement with the Ministry of the Economy and Finance, to reduce the monthly rate from 1 February to 1 July 2023 is to be welcomed, as it will certainly make it possible to facilitate access to credit, provided that banks are inclined to lend. Notwithstanding this

technical measure, the continuing rise in interest rates is excluding more and more people from the property market, in the face of a greater demand for down payments. The notaries have noted an increase in the number of loan refusals, in particular, as revealed by the Banque de France figures, a decrease in the share of first-time buyers in the production of housing loans for the acquisition of a

main residence since December 20211. It is customary to say that the real estate year is made in the spring, and March will be decisive in the trajectory that the market will take. The confirmed start of the current fall in volumes and the deceleration in prices could only be the sign of a half-yearly adjustment and a return to normal, mirroring 2022 which experienced a two-stage process, with a very active first half and a second half marked by gloomy macroeconomic parameters and low household confidence. In any case, the property market could just as well continue to decline, given the great number of clouds gathering over it, even

though the appetite of the French for the safe haven of real estate is undiminished.

1 www.banque-france.fr/statistiques/credit/credit/credits-aux-particuliers

In the 3rd quarter of 2022, prices of old properties continued to slowly decrease

In the 3rd quarter of 2022, the increase in the price of old properties in mainland France slowed to 1.5% compared to the 2nd quarter of

2022 (provisional seasonally adjusted data). Year-on- year, prices decelerate slightly with +6.4%. The increase has remained more significant for houses (+8.2% year-on-year) than for apartments (+4%) since the 4th quarter of 2020.

Outside Paris, the increase in the price of old houses continues at a rate comparable to the last two quarters. In the 3rd quarter of 2022, they increased by +1.8%. Year-on-year, prices remain very dynamic with +8.1%. Since the beginning of 2021, the prices of houses outside Paris (+8.6% year-on-year in the 3rd quarter of 2022) have risen more than those of apartments (+7.1%), although it was the opposite in 2019 and 2020.

In Île-de-France, the prices of old houses increased over a quarter for the 3rd consecutive quarter with +0,6%. Year-on-year, prices also increased by +2%. This steady increase was more significant for houses (+5.7% per year) than for apartments (+0.2%). This stronger growth of house prices in Île-de-France has been observed since the 4th quarter of 2020. In Paris, apartment prices remained almost stable over the quarter for the 3rd consecutive quarter with -0.1%. However, prices of Paris apartments dropped year-on-year (-1.2%).

Preliminary contracts

In mainland France, according to projections at the end of February 2023 based on preliminary contracts, the slowdown in the rise in prices of old properties should be significant at the end of February 2023: +4.6% year-on-year. Prices of old houses should still increase more than those of old apartments, but the differences should be smaller, with +5.5% and +3.3% respectively at the end of February 2023 (compared to +8.2% and +4% in the 3rd quarter of 2022).

According to prices from preliminary contracts, the price per m2 of apartments is expected to be €10,500 in February 2023 in Paris. The very slight erosion of values should therefore continue in the Capital but without intensifying.

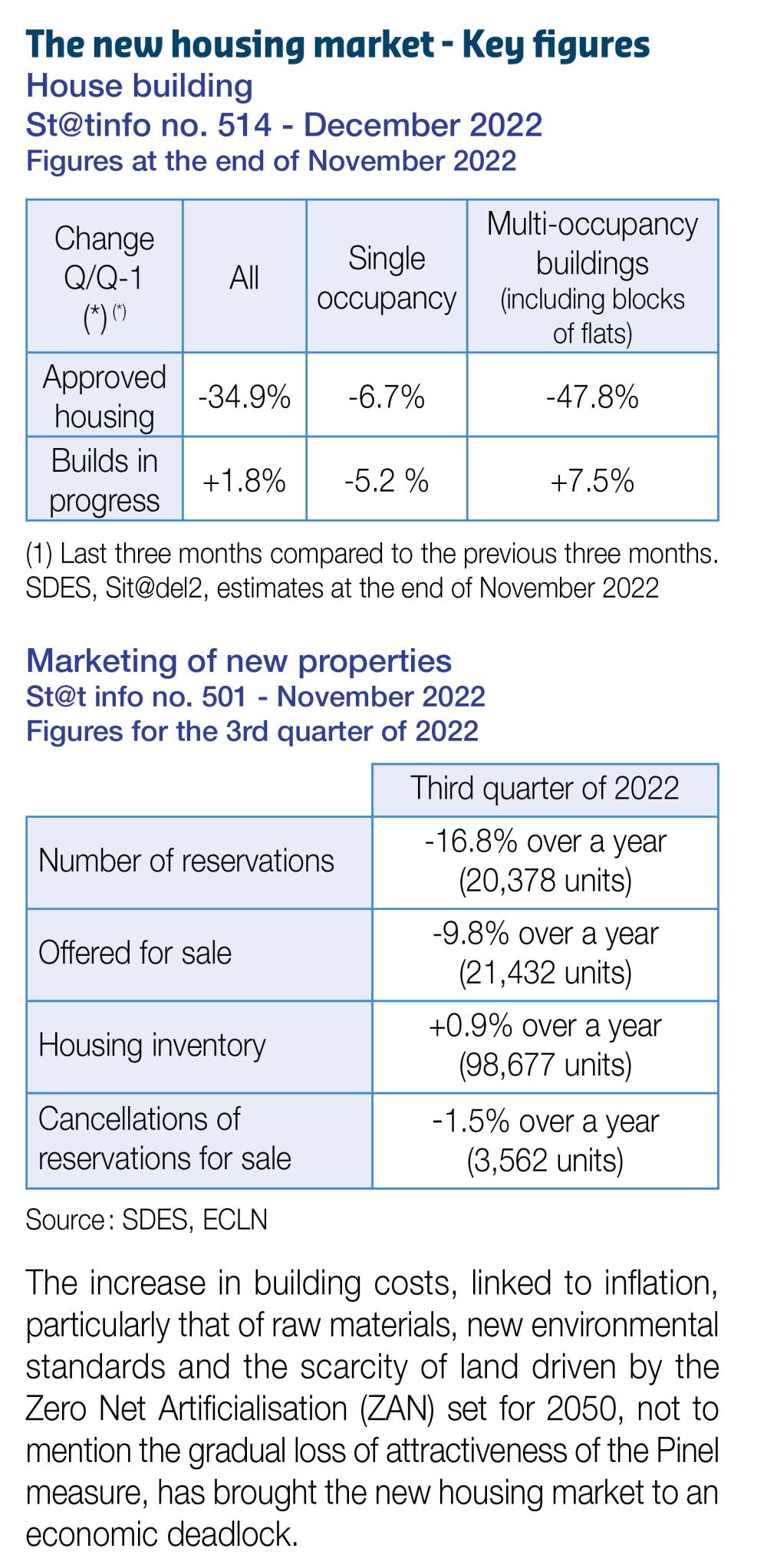

The new housing market - Key figures

Image (1000*yyy)

The increase in building costs, linked to inflation, particularly that of raw materials, new environmental standards and the scarcity of land driven by the

Zero Net Artificialisation (ZAN) set for 2050, not to mention the gradual loss of attractiveness of the Pinel measure, has brought the new housing market to an

economic deadlock.

Credit - Banque de France data - Results at the end of August 2022

In November, the seasonally-adjusted flow of new housing loans amounted to €18.3 billion (after €18.6 billion in October), while interest rates continued to rise, with the effective rate in the narrow sense (i.e. excluding fees and insurance) averaging 1.91% (after 1.77% in October). The annual growth rate of outstanding housing loans stood at +5.7% in November, after +5.9% in October. The growth rate of consumer credit was

+4.0%, after +4.3% in October.

The December estimate for new housing loans indicates a continued rise in the average interest rate to 2.04% and a monthly seasonally-adjusted production of these loans of €15 billion. Over the year, the growth rate of outstanding housing loans is estimated at +5.5%. Excluding renegotiations, and adding the very first estimates for December, cumulative new loan production for the year should be €218.4 billion, i.e. an all-time high apart from the exceptional year of 2021, which 2022 only falls short of by 3%.

Image (1000*yyy)

Business premises in mainland France: a heterogeneous market focused on city catchment areas

The business premises market in mainland France is very heterogeneous. It mainly comprises shops, with 45% of transactions taking place in 2021.

Next come offices (16%), warehouses or furniture storage (15%), craft activities (12%) and medical activities (5%). The rest of the transactions concern service stations and garages (3%) and hotels (3%). This breakdown by use has remained stable since 2017.

Only 6% of business premises transactions take place outside of city catchment areas (CCA)1. Compared to 2017, the share of business premises transactions carried out in city catchment areas has slightly decreased in the central municipalities (40% compared to 43% in 2017) in favour of those carried out in the surrounding areas (34% compared to 32% in 2017). Non-trading property companies account for 60% of buyers of business premises.

Image (1000*yyy)

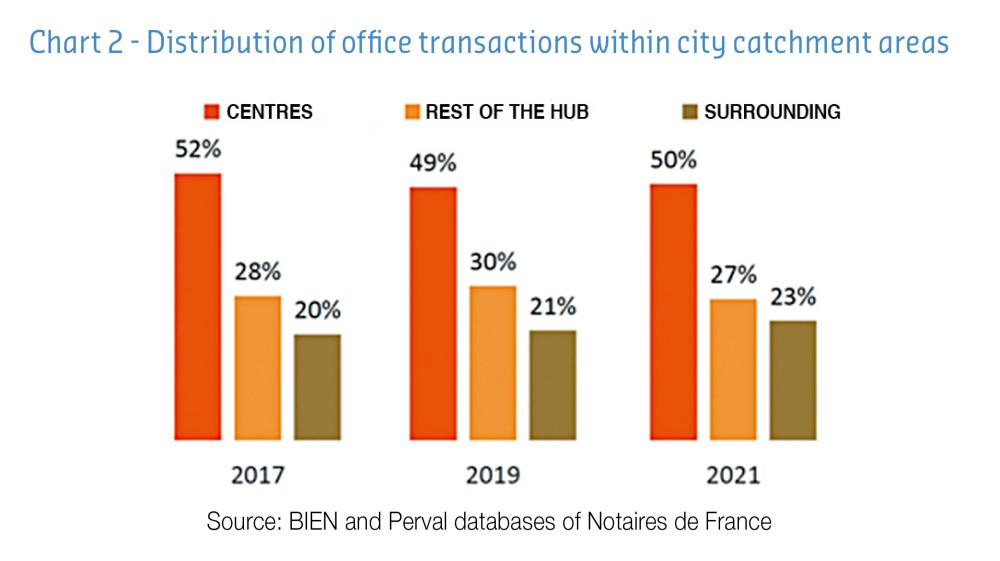

In 2021, in the city catchment areas, 50% of offices will be acquired in the central municipalities (compared to 43% for all business premises). Compared to 2017, the share of office space acquired in the central municipalities and the rest of the hub has fallen slightly in favour of surrounding areas, to 23% in 2021 from 20% in 2017.

Image (1000*yyy)

Compared to 2019, office prices acquired outside Paris in 2021 have increased much more in the central municipalities (+21%) than in the rest of the city catchment areas (+8%). Over the same period, the median surface area of the main premises also increased in the central municipalities (from 106 to 113 m2 in 2021), while it has remained almost stable in the rest of the city catchment areas.

Office prices are more heterogeneous in 2021. In the central municipalities, half of the offices were sold for around €90,000 to €300,000 in 2017 and 2019, compared to €100,000 to €390,000 in 2021. This phenomenon is also observed in the rest of the city catchment areas from 2019.

Image (1000*yyy)

1 - Breakdown defined by the Insee (www.insee.fr/fr/information/4803954)

The municipalities have been grouped into 4 groups based on the categories defined in the Insee’s 2020 City Catchment Area (CCA) zoning:

- Centres: “Central” municipalities (the most populated within each CCA hub)

- Rest of the hub: other municipalities in the main and secondary hubs of the CCA

- Surrounding area: municipalities in the surrounding areas of the CCA hubs

- Outside of catchment areas: other municipalities not belonging to a CCA